Most people get into crypto with big plans. You create a strategy, track the charts, wait patiently for the right moment – and then reality kicks in. Prices move while you’re at work, asleep, or simply away from the screen. By the time you notice, the opportunity is gone.

That gap between planning and execution is exactly why traders start looking at automation in crypto trading.

For years, automation felt like something only developers could use. Writing scripts, dealing with APIs, fixing technical errors – none of it sounded beginner-friendly.

That’s where Delta Exchange changes the story. As a leading Indian crypto exchange, it offers simple tools that let you automate crypto derivatives trading without feeling overwhelmed.

Why Automation in Crypto Trading Has Become So Popular

Manual trading works, no doubt. But it has limits. It’s natural for us to hesitate, miss signals, or follow market hype while trading (which could lead to loss).

Automation in crypto trading removes those weaknesses. You can:

- Enter trades at the exact price you planned.

- Follow a strategy without emotions.

- Trade even when you’re away from the screen.

- Stick to the rules consistently.

For active users of any Indian crypto exchange, this can be a big upgrade from clicking buttons all day.

Delta Exchange is Built With Automation in Mind

Unlike many platforms where automation in crypto trading feels like an afterthought, Delta Exchange treats it as a core feature.

The platform offers:

- API-based crypto trading tools.

- Ready-to-use algo trading bots.

- Webhook connections with TradingView and TradeTron.

- Clear guides for beginners.

- 24/7 monitoring and trade execution.

All of this works directly inside the Delta Exchange app, so traders don’t need complicated external setups.

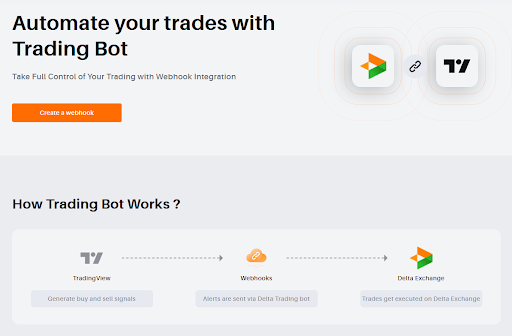

Trading Bots: Automate Trades Without Writing Code

One of the easiest ways to automate on Delta Exchange is through its algo trading bot setup.

The idea is simple:

- Your strategy sends an alert.

- Delta Exchange receives it.

- A trade executes automatically.

These alerts can come from TradingView or other charting tools. Once connected, you can buy and sell signals that turn directly into live orders on the Delta Exchange app.

For beginners, this approach removes the biggest barrier. You don’t need to write code or build software from scratch. You just connect signals to your account and let the system handle execution.

APIs for Traders Who Want More Control

Some users want deeper customization, and that’s where Delta Exchange APIs come in.

The platform offers complete API access so that you can place and cancel orders, track positions, readjust strategies in strategy builder, and much more.

Delta’s APIs make it easier for first-time users to experiment with automated workflows. Even if you’ve never used APIs before, the guides explain each step in plain language, helping you grow from basic automation to more advanced setups at your own pace.

Getting Started is Easier Than You Think

You can trade crypto futures and options on major currencies like BTC, ETH, and other altcoins. All you have to do is:

- Log in to your Delta Exchange account and create a webhook URL. This link connects your TradingView alerts directly to your trading account.

- Set up or choose your trading strategy on TradingView. Once ready, create an alert and paste the webhook URL into the alert settings.

- Format the alert message using Delta Exchange’s supported syntax so the platform knows exactly what action to take.

- Whenever the alert triggers, TradingView sends the signal instantly to Delta Exchange through the webhook.

- The bot then executes the order automatically – buy, sell, or exit – exactly as your strategy defines.

Why Delta Exchange Feels Beginner-Friendly

Unlike other Indian crypto exchanges, Delta Exchange approaches automation from a user-first angle.

- Clear interfaces.

- Simple bot connections.

- Well-documented APIs.

- Practice-friendly demo mode, without real funds.

All of this makes the Delta Exchange app feel approachable rather than intimidating, especially for those trying automation in crypto trading for the first time.

Final Thoughts

Automation used to feel like something only professional programmers could handle, but Delta Exchange changes that idea completely.

With trading bots, easy APIs, and practical guides, this Indian crypto exchange gives newcomers a smooth path for automation in crypto trading. You don’t need advanced skills – just a clear strategy and the willingness to test and learn.

For Indian traders looking to move beyond manual clicks and missed trades, Delta Exchange offers a simple, sensible starting point for the future of trading.

To start testing crypto trading strategies, visit www.delta.exchange or join Delta on X for the latest updates.

Disclaimer:Cryptocurrency markets are subject to high risks and volatility. Kindly do your own research before investing.