Crypto trading is evolving as more traders are looking beyond the basics. Futures and options offer many ways to trade when prices move, even when the market is not trending.

But for beginners, crypto derivatives might feel confusing. Between all the new terms like leverage, expiries, etc., it’s normal to get stuck before placing the first trade.

This guide breaks down crypto F&O trading, why it can feel a bit difficult at first, and how Delta Exchange makes it easy for beginners. It also covers key platform features, how to get started, and the most common mistakes to avoid.

What is Crypto F&O Trading?

Crypto F&O is no different from futures and options for any other capital market – where traders don’t always have to buy the actual asset, in this case – the underlying cryptocurrency. Instead, they trade contracts tied to the prices of popular assets like Bitcoin and Ethereum.

Futures are legal contracts that let you speculate on where the price is headed next. For example, if you think that the BTC might go up, you can hold it for a long time. But if you feel that it could go down, you can short it at any time. Futures give you a way to take positions on price movement without directly owning the coin.

Options work a little bit differently. They give traders the right, but not the obligation, to trade at a fixed price before a certain expiry date. Many traders use options to set clearer risk limits for trades or to manage uncertainty during volatility.

Why Does Crypto F&O Feel Tough for Beginners?

Derivatives can feel tough for beginners because they come with a lot of new things. Terms like margin, liquidation, funding fees, expiry, etc., can feel confusing, especially if you’re only used to basic spot trading.

Another big issue is leverage. Many misunderstand how quickly losses can grow, which makes crypto F&O risky from the start. And choosing the right contract can be overwhelming, as traders need to think about expiries, lot sizes, and contract types.

How Does Delta Exchange Simplify Crypto Derivatives for Beginners?

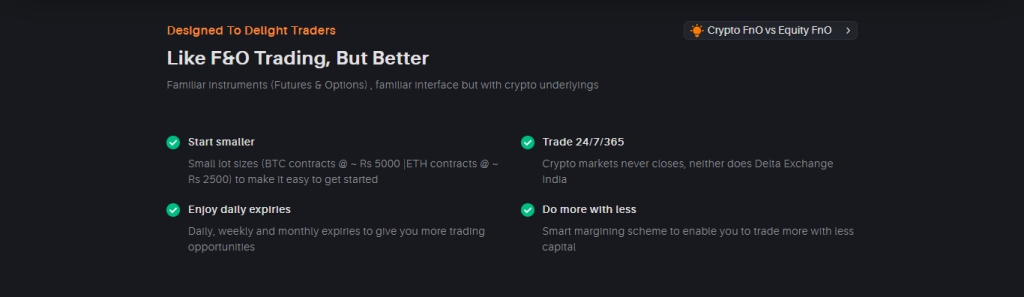

Delta Exchange makes crypto trading way easier for beginners. Beginners can locate F&O products without confusion and understand what each contract represents. Tracking open positions, margin usage, P&L, and many other things. These are useful for moving beyond basic spot trading and learn crypto F&O.

As an Indian crypto exchange, Delta fits the habits of retail traders. Providing smoother onboarding, faster execution, and a platform that supports learning.

Key Delta Exchange Features That Make Crypto Trading Easier

- F&Os with multiple expiries

F&O trading lets you pick contracts that match your preferred timeframe and approach.

- Options expiry: Daily, weekly, and monthly on Bitcoin and Ethereum.

- Futures expiry: Perpetual contracts.

- Leverage: Up to 200x and independent of trading capital.

- INR trading

This helps Indian users start crypto F&O trading without getting into currency conversions.

- INR-based bank deposits and withdrawals via UPI, IMPS, and NEFT.

- No charges are levied on deposits and withdrawals.

- Balances and unrealized profits remain in INR.

- Lower trading fees

Helps you trade and learn without fees eating into your profits or practice trades.

- Futures trading fees:

- Maker: 0.05%

- Taker: 0.02%

- Options trading fees:

- Maker: 0.010%

- Taker: 0.010%

There’s an 18% GST on trading fees, and to avoid additional cost, the option fee is capped at 3.5%.

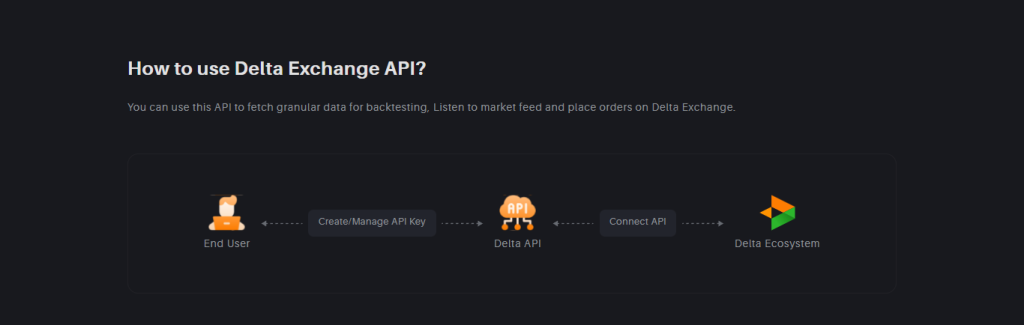

Instead of manually placing orders, trading can be automated by connecting the accounts to custom trading bots, an algo strategy, or a 3rd-party tool using Delta’s API.

- Placing market or limit orders.

- Setting up stop-loss or take-profit orders.

- Monitoring prices and positions 24/7.

- Small lot sizes

Enhance risk control by allowing traders to start with smaller positions and lower exposure.

- Easy to get started with BTC contracts at Rs 5000 and ETH contracts at Rs 2500.

- Algo trading bots

Support rule-based execution so you can trade with more structure and less decision-making.

- Automate complex strategies without writing a single line of code.

- Add customized alerts.

- Real-time order execution with minimal latency.

Delta also provides leverage-based exposure, which mainly works best for controlled hedging, portfolio diversification, and disciplined risk management.

Steps for Beginners to Start Crypto F&O Trading on Delta Exchange?

Signing up for Delta is pretty simple; all they have to do is just

- Visit the Delta Exchange website

- Register using email, Google, or Apple accounts

- Complete your KYC verification using PAN, Aadhaar, and a selfie.

- Add a bank account

- Make a deposit, and the trader is good to go.

- Pick your product. You could go for the futures or options.

- Start with trading in small lot sizes.

- Stick to the basics, like putting up a stop loss, position sizing, etc.

It’s recommended to check the fee structure.

Common Mistakes Beginners Should Avoid.

- Using high leverage without knowing how quickly losses can grow.

- Choosing random futures or options.

- Ignoring trading or any other kind of fees that could directly impact your profits.

- Overtrading when confidence is high, or forcing trades after a loss to make it back.

- Copying trades through social media or from online platforms without knowing the strategies.

Final Thoughts

Crypto F&O might seem complicated, but things get easy by learning the basics with the right approach. But as an Indian crypto exchange, Delta helps make learning much smoother. By offering F&Os with multiple expiries, INR trading support, lower fees, small lot sizes, and algo trading bots.

Even though crypto is evolving, all these features are helping the traders to evolve, too. Together, all of this makes it easier for beginners to start small, stay organized, and trade with more structure rather than guess.

For more information, visit www.delta.exchange or join Delta on X for all the latest news and updates.

Disclaimer: Cryptocurrencies are highly volatile and contain risks. Kindly do your own research before investing in any digital currencies or crypto derivatives.